Tungsten and Cobalt Prices: Market Correction Amid Holiday Caution

This week, tungsten prices remained weak and stagnant as more sellers looked to cash out while buyers delayed replenishment. Major tungsten enterprises lowered guide and contract prices, further weighing on sentiment. Compared with the earlier rally, the current correction appears more rational.

With China's Mid-Autumn Festival and National Day approaching, the market is expected to stay cautious, awaiting policy signals and downstream restocking.

Tungsten Concentrates: 65% black tungsten at RMB 272,000/ton and white tungsten at RMB 271,000/ton, both down 2.2% week-on-week but up over 90% year-to-date.

APT: Domestic RMB 395,000/ton, down 2.5% on the week but up 87% YTD; European USD 570–650/mtu, up 2.1% week-on-week.

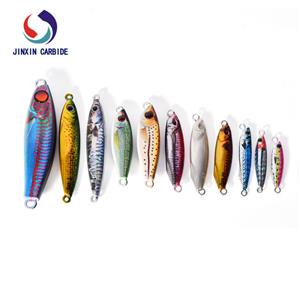

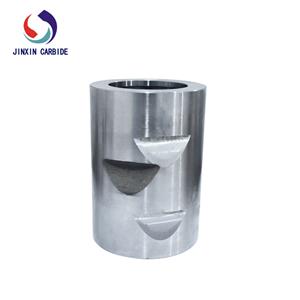

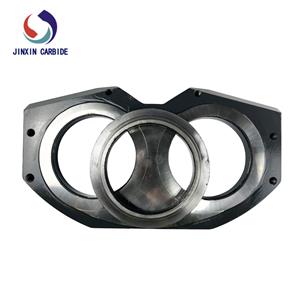

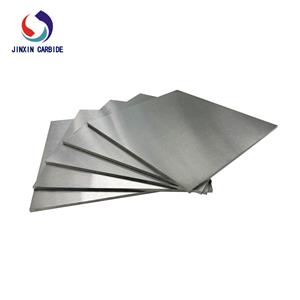

Powders: Tungsten powder at RMB 630/kg and tungsten carbide powder at RMB 615/kg, both down 0.8% week-on-week but nearly doubled YTD. Cobalt powder surged 16.9% week-on-week to RMB 380/kg, up 123.5% YTD.

Ferrotungsten: RMB 390,000/ton, down 2.5% week-on-week but up 81.4% YTD.

Scrap Tungsten: Bars at RMB 385/kg and drill bits at RMB 370/kg, stable week-on-week but up 75% and 62.3% YTD respectively.

Overall, the market is adjusting under cost pressures and cautious sentiment, with long-term bullish fundamentals supported by tungsten's scarcity and strategic value.